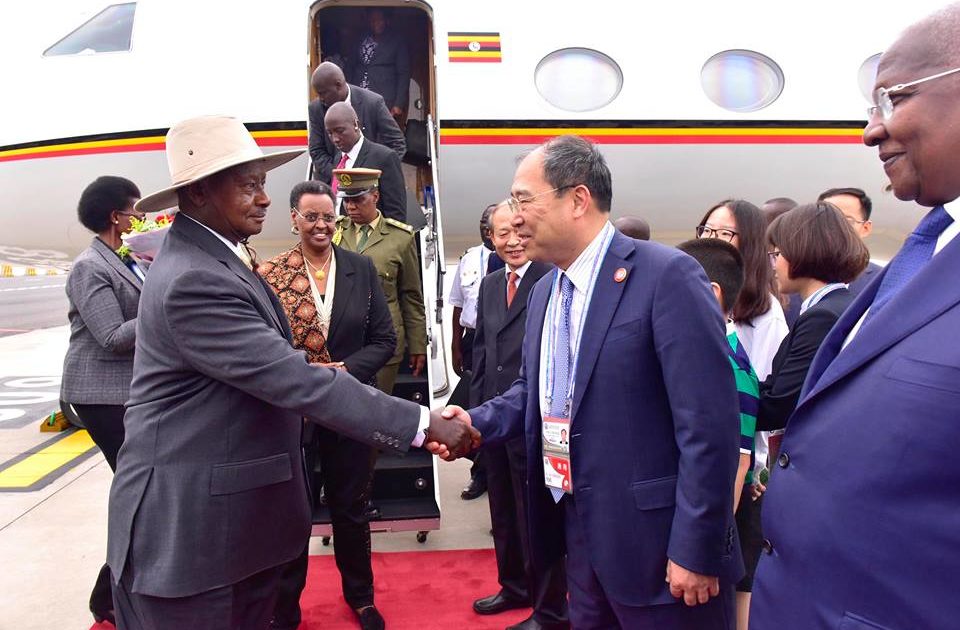

Uganda president Yoweri Museveni in China for FOCAC Summit: COURTESY PHOTO

With a wave of Imperialistic tendencies sweeping the world with what has been termed as China’s “debt traps”, how safe is Uganda.

29% of Uganda’s total loans is owed to China’s EXIM Bank.

China- Uganda loans

Loan agreement performance data (2016) indicate that China committed $350m for Entebbe-Kampala Expressway, $100m to improve road networks, $483m for Isimba hydropower plant and $1.4b for Karuma Dam and many others in the year 2016.

China alone has a loan commitment totaling to $2,588,078,279. Over, the last four years, Uganda has seen an increasing share of Chinese loans in roads and energy projects in excess of $3b.

Uganda’s debt to Uganda exceeds 10% of Uganda’s current GDP at $27.53b (World Bank, 2015).

The China ‘debt trap’ genesis

In the past two years, China has been taking over territories of her ‘bad debtors’ who owed China alot of money and failed to pay.

The very first country to fall prey to Chinese ‘debt trap’ was Syri-lanka. Officially known as the Democratic Socialist Republic of Sri Lanka, is an island country in South Asia, located in the Indian Ocean.

In December 2017, Sri-Lanka handed over Hambantota port to China on a century-long lease over failure to pay. The port was built with $1.3bn loan from China at 6.3% interest. However, it failed to fully pay the loan. This year, the country owes nearly $13 billion, out of a forecast revenue of less than $14 billion. We don’t know what next China will take in case of failure to pay.

Zambia did not skip the trap, talks are underway for China to take over Zambia’s state power company Zesco after the country defaulted on loan payments, a report by Africa Confidential claimed.

Djibouti, home to the US military’s main base in Africa, looks about to give away the control of key port to a Beijing-linked company

Uganda’s stake

An analysis by Quartz on the 8 most vulnerable countries on China debt overload puts Djibouti first, followed by Tajikistan.

Although Uganda is not enlisted among the most countries in danger of the china’s Road and Belt initiative, it should not settle in a comfort zone.

Most of the loans that Uganda procured from China are to be repaid within an average period of 10 years.

However, the loans were used for long term assets which may not yield returns in the long run.

China’s plan

Beijing’s multibillion dollar Belt and Road Initiative (BRI) has been called a Chinese Marshall Plan, a state-backed campaign for global dominance, a stimulus package for a slowing economy, and a massive marketing campaign (The guardian)